Online banking security issue on rise: Is your money safe?

- Szemih Tan

- Aug 2, 2022

- 4 min read

Written by: Tan Sze Mih

Is online banking safe anymore? Recently there has been much news circulating around the Internet that people have had their online banking accounts breached with funds taken away without any authorisation. Based on the data and statistics obtained from the Royal Malaysia Police, the people in Malaysia suffered a loss of roughly RM2.23billion since 2017 due to cybercrime frauds.

With the information given by a Russian cybersecurity company, Kaspersky Lab, it is shown that there has been a 266% increase in web threats in Malaysia since 2017. This would decrease in 2019 and rise again in 2020 by 33%, and an extra 26% in 2021.

Although companies like Kaspersky Lab have done an adequate job of ridding web users of these web threats, there have still been many cases of cybercrime frauds. So, how can people avoid these web threats, and are people really safe from cybercrime, even with the help from these cybersecurity companies?

Koay concern about online banking security issue

Koay Jian Hao, an engineer working in Penang said that he is worried about his online banking account privacy as he saved up quite a large amount of money, which is mostly for his children's education, which is very important to him.

He shared news of a man in Kuching that lost roughly RM30000 through 14 different online bank transfers and it happened in only less than 15 minutes.

“If the money were to be gone like the man from Kuching, I would not know what to do after that,” said the 28-year-old father.

“My mom recently almost fell victim to a phishing scam, she clicked on a shady advertisement while browsing the Internet,” said Koay.

“Luckily I was there with her and managed to close the link quickly and stopped any viruses with my paid antivirus software that I have installed on my computer,” he added.

Goh Chin Jie

“I lost RM50,000 and the bank officer said that the money cannot be tracked back,” said Goh Chin Jie, a victim of an online scamming case.

“I panicked when I received the call, the person said he is from the Pahang Police Station, and that someone had used my Identity Card to register a company and that I was in trouble,” he memorised the conversation he had with the then alleged scammer.

“He then told me to download an application through a link and use it to make a report,” he sighed.

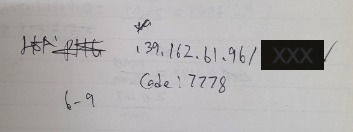

The phishing link and code

The report in the application took an unusually long time to process and he thought that it was strange, so he then checked the notifications on his phone and found out that he had gotten confirmation messages that multiple transactions had taken place with succession.

Goh also mentioned he lost his IC a few months ago, therefore his decision was affected as he did not suspect the call.

“Even though I called the bank immediately and froze my account, the bank didn't manage to track back the money,” said the 22-year-old victim.

Ivan who studies oversea prefer to use online banking

Ivan Lo, a 21-year-old Malaysian who is currently studying in Singapore stated that he mainly uses online banking for online purchases and paying the rental.

“I do link my online bank account to Shopee Grab Google Play Store,” he said.

Even though he experienced online banking security issues before, he still uses online banking as it is very convenient.

“Linking accounts is much easier when it comes to reload and payment,” he said.

“I only found out later that there is a few transactions around RM700 transferred out of my account but I managed to get the money back when I informed the bank about the issue,” he then added.

Ivan suggests avoiding public use of banking apps and also connecting to public Wi-Fi when doing transactions.

Nyeow Kai Ming

Nyeow Kai Ming, 29-year-old, who works as a teacher in a primary school in Johor said that he is worried about his account privacy.

“My bank account details got compromised and RM1.3k was stolen from my bank account as I did online payment at an online shopping website with a public wifi,” he said.

He thinks that having a credit card is much safer than using an online banking account as credit cards offer fraud liability protections, so it comes with fewer risks when purchasing items online.

As a teacher, Nyeow suggest the school to take actions in helping the students to raise awareness toward online banking security issues.

“The school could probably start a campaign or they could invite an expert in cyber security to have a talk with the students because many of the students have their own mobile phones, they would very likely be using apps that have funds like TnG or Grab.” he explained.

Lim suggest strengthen passwords to secure online banking account

“I do not link my bank account to any other apps as it does not benefit me,” said Lim Hur Vin, 19, a student majoring in cybersecurity.

“Most cases about deposits in online banking accounts being stolen were stolen through sketchy apps that people have given their personal information or bank account details.”

Lim suggested always enabling 2FA (Two Factor Authentication) in trustworthy apps or websites when it's available.

“You could also strengthen your passwords and make each one of them unique so if one of the passwords gets leaked, it wouldn't risk the other linked websites,” he said.

Comments